Location: Millennium Gloucester Hotel London, 4-18 Harrington Gardens , SW7 4LH

![]()

If you Don’t Invest in Property Now,

You Would Miss your Chance FOREVER!

Here is why…

It’s possible to turn a few thousands into multiple thousands just by doing some work to it. In fact it’s the only investment that banks would be willing to lend you money to buy it.That’s a good reason for it – banks know that properties will always go up in value in the long run. Unlike other investments, if the market crashes, property always has its residual value, meaning that you can still make your money back by selling the house brick by brick!So if you don’t invest in property and do it now, you would “miss the boat” once and for all and only live to regret it afterwards.

It’s possible to turn a few thousands into multiple thousands just by doing some work to it. In fact it’s the only investment that banks would be willing to lend you money to buy it.That’s a good reason for it – banks know that properties will always go up in value in the long run. Unlike other investments, if the market crashes, property always has its residual value, meaning that you can still make your money back by selling the house brick by brick!So if you don’t invest in property and do it now, you would “miss the boat” once and for all and only live to regret it afterwards.

Why Most Of You Will Never Stand

A Chance Of Succeeding In Property!

Even if you manage to find the deals, you won’t be able to finance them.Prior to that, property was very forgiving of mistakes. There seemed to be only one way that prices were going and that was up! Anyone could make money in property and it was very forgiving of mistakes.Not anymore!Since the recession began, many successful investors have either gone bankrupt or lost a great deal of money. Even the most experienced investors don’t have a clue now on what to do. If you make mistakes, it could wipe you out completely.

Even if you manage to find the deals, you won’t be able to finance them.Prior to that, property was very forgiving of mistakes. There seemed to be only one way that prices were going and that was up! Anyone could make money in property and it was very forgiving of mistakes.Not anymore!Since the recession began, many successful investors have either gone bankrupt or lost a great deal of money. Even the most experienced investors don’t have a clue now on what to do. If you make mistakes, it could wipe you out completely.

If you are starting out in property in today’s market, what chance do you have?

Property + Entrepreneur = Propepreneur

What that means is that when times are hard for most people, it is a business opportunity for some. This group of people tends to do the opposite of what the others do – they start new businesses when most were closing down and invest in property when most are selling.They make money by adding value to people according to what is needed in those circumstances.They are called entrepreneurs.

What that means is that when times are hard for most people, it is a business opportunity for some. This group of people tends to do the opposite of what the others do – they start new businesses when most were closing down and invest in property when most are selling.They make money by adding value to people according to what is needed in those circumstances.They are called entrepreneurs.

We are experiencing the same interesting times in property. Prices across many countries have dropped to rock bottom and few people know what to do anymore. Those who do are the property entrepreneurs or “propepreneurs” who are making more money than ever.

In fact you probably won’t find another opportunity to make money in property like the times we have now for decades to come!

You need to become a propepreneur if you were ever going to stand any chance of succeeding in property.

The 12 Killer Mistakes That Will

Wipe You Out Instantly.

The Biggest Myth About “Repos”

And Why Most People Never Make Dime!

Many so-called seasoned investors are now looking at repos. Repos are properties that are going through repossession by their banks because the owners can’t keep up with their mortgage payments.There are companies around that are offering repo lists that contain names and addresses of the properties that are going through the process. Some of these lists might contain some phone numbers of the owners but that’s few and far between.

Many so-called seasoned investors are now looking at repos. Repos are properties that are going through repossession by their banks because the owners can’t keep up with their mortgage payments.There are companies around that are offering repo lists that contain names and addresses of the properties that are going through the process. Some of these lists might contain some phone numbers of the owners but that’s few and far between.Here are the problems with repo lists…

- Almost all of them have “gone round the block” many times – do you think the list seller would sell you the entire list exclusively?

- Most owners would ignore your call as much as all the creditors’ chasing them for money and many have already had their phone lines cut off!

- By the time you get the repo list, it’s probably too late. Most repossessions take place because they have already gone through the court process due to the sellers owing the banks thousands of pounds of arrears.

- Even if you get to speak to the banks, they will simply ask you to put in an offer based on the price. Unless you have the finances ready, the chance is that you can’t even buy it.

- The critical success factor in doing property deals in today’s market is if you could negotiate with the sellers directly based on the terms. Banks would never negotiate on terms.

I’m not saying that you can’t help people going through repossession. They key is to help them before they get to that stage.

The New Definition Of A Property Deal

As you can see, the whole idea of a property investor is no longer what it used to be.

![]()

They get paid their commission on the price and not the terms!

How To Become A Property DEAL MAGNET

And Not A Deal BEGGAR

Point number three above is the KEY to your success. What I am talking about is a business system that works for you.That means you need to treat property as a business and you become a business owner. If you are willing to take property seriously, your chance to succeed would be dramatically increased.I don’t know if you have ever started a business or are already a business owner. In reality, most people prefer to work in a job rather than become a business owner. Probably the reasons are that:

Point number three above is the KEY to your success. What I am talking about is a business system that works for you.That means you need to treat property as a business and you become a business owner. If you are willing to take property seriously, your chance to succeed would be dramatically increased.I don’t know if you have ever started a business or are already a business owner. In reality, most people prefer to work in a job rather than become a business owner. Probably the reasons are that:

- They perceive business as risky

- There is too much hassle and headaches

- They don’t now how

- They have little start-up capital

- They have no time

It’s true that most start-ups fail in the first 18 months.

Why? It’s a steep learning curve. People make mistakes in business always and that’s the name of the game – you learn from them as you grow.

While there are always risks in business, risks and rewards go hand in hand. That’s why successful business entrepreneurs travel the world in first class, live in amazing houses, own the most expensive toys and have the means to do charity work and give back to the society.

While most people are passionate about helping others, the reality is that most can’t even look after themselves.

If you don’t want to miss the boat again, read on…

Our first deal… £1100 a month!

“After working with John and Vince

we did our first deal where the

cash flow is

£1100 a month!”

Alex & Ivla

I acquired a 100k house for 2,000

“Within 2 weeks of learning the strategies from the bootcamp

I acquired a 100k house for 2,000

and after 17 years

the house will be mine.”

Katie Wardel

I completed on 70 property deals and I never looked back

“I met I attended John and Vincent’s

4 day bootcamp in 2010 on which

I completed on 70 property deals

and I never looked back.”

Colin Mir

They are the practical Guru’s

“I have been working with John and Vincent for 4 years and now I own over 30 properties. They are the practical Guru’s.”

Christine Hertough

..a property deal that make me £400 NET a month

“Through the support of the wealth dragons John and Vince I have completed on a property deal that make me £400 NET a month“.

Thank you.

Julie Hogbin

I decided to take action…and earned £5,000 alone

“I very skeptical when

before I attended the course but

I decided to take action

and now I have down 5 below

market deals and earned

£5,000 alone plus now doing

my first deal option deal.”

Joseph Brissett

Made £21,000 in instantly

equity from Day 1

“I didn’t know if this really worked

but after John from John and Vince,

I bought a 2 bed midd terrace

and made £21,000 in instantly

equity from day 1“.

Tommy

I am so glad I gave these

guys a call

“I bought one of Vincent’s leads for £100 and managed to turn that into £33,000 in 2 months, I am so glad i gave these guys a call.”

Andy Ford

..Having results so fast

I am so pleased I joined

“After using Vincent’s techniques

I bought a flat in Glasgow below

market value and makes £300 cash flow a month.

After having results so fast

I am so pleased I joined.”

Amadanda Phillips

Started with no knowledge…now made £5,000 with from flipping one deal

“I started with no knowledge and started working with John and

Vince where I have now made

£5,000 with from flipping one deal.

Take the action thats all I can say.”

Brad Madden

John Lee and Vincent have really changed my life!

“I graduated from Wealth Dragons Bootcamp in 2012 and I have since

on completed on 6 property deals

with £220,000 Equity, I was able to

quit my job and get into property

full time John Lee and Vincent have

really changed my life!”

Enoch

John’s the right person

“Last year learnt from John and Vincent on and in 8 months

I Pocketed RM 200,000.

John’s the right person to

learn all this from.”

Micheal Cheng

- You need to know what the new rules or strategies are – some of these strategies are next to zero risk investing!

- Have multiple streams of income.

- Learn the mistakes that have cost people time and money and you avoid them at all cost.

Many investors have lost money in property because they don’t know what the deal breakers are.

Therefore, you must know…

Here are some examples of typical deal breakers:

- Not having the right solicitors

- Mortgage lenders pulling the plug at the last minute

- Getting the valuation wrong

- Saying the wrong thing at the wrong time to mortgage lenders, sellers and surveyors

- Unsolicited advice, e.g. friends, family lawyers, so-called experts on forums…

The property business could be disastrous for you if you don’t do it right. You could get:

- Hassle from tenants who don’t pay you

- Tenants trashing your house

- Maintenance and managing your builders

- Your phone constantly ringing

- You wasting time driving around

- Your rents not covering your mortgage

- Void periods

There is one little known strategy that could save you from all of the above.

The “Strategy” that Eliminates the Headaches from Property Once and for All.

Once you learn this strategy, you would find the perfect tenants that

- Pay you on time

- Pay you more rent

- Take care of your maintenance

- Stay for years so you don’t worry about them handing in their notice

- Willing to fix up your house at their cost

This strategy is what the most successful property investors use today. There is a HUGE demand that is not being met right now and that’s why we need to share with you this opportunity with you so we could work together.

When you come to this event, you’ll also learn…

- How you can get started in property and beat the pro’s with no experience

- Stop losing money in the bank and make your money work hard for you

- How you build income assets that look after your retirement and leaves a legacy

- Where you can find all the money to invest that other investors have no clue about

- The “strategy” for building a property business on the side even if you have no time

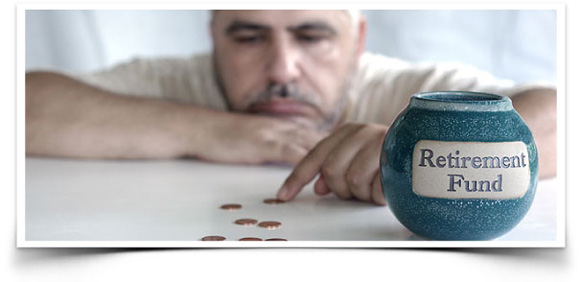

Do You Even Stand A Chance of Retiring At Retirement Age?

Let me share with you a little known fact.

According to a recent survey, most people have almost no chance of retiring at their retirement age.

Here’s a little calculation…

Let’s say you plan to retire on £3,000 a month to live comfortably at the age of 65.

You would need £3,000 x 12 months = £36,000 a year.

The average life expectancy in the UK is 80 years. That means there are 15 years left that you have to fund before you die.

By the time you retire, you would need to have saved £36,000 x 15 years to live = £540,000 in the bank. With inflation, it’s likely to be double to £1,080,000.

So the question is… what are you doing right now to make sure you have this kind of money in your bank by the time you are 65 so you can live comfortably?

What are you going to do when your income stops when you retire? (Hint: Have lots of properties that make you money every single month without having to work)

If you don’t own any assets, the chance is that you are highly unlikely to retire comfortably, let alone retiring early.

The 1:10 Strategy to Retire Early while Others Retire Broke

It’s crucial that you learn them and take action right now because…

- The earlier you start, the faster you can retire – your legacy starts now

- Time is running out (how long do you have to live?)

- This market is a once-in-a-lifetime opportunity and there probably won’t be another one for decades to come

- If you don’t do it now, you will never make money. This is your opportunity cost.

- You are losing your savings due to inflation

- If you don’t invest your money now, you would end up spending it anyway

The Quickest Way to Invest in Property without Saving for Years for a Deposit

It’s the truth – there are millions of people renting property right now because they can’t save enough money for a deposit to buy their first home, let alone becoming a property investor.

Many are well into their 30s / 40s and have resorted to living at home.

When you come to this event, you’ll quickly learn that:

When you come to this event, you’ll quickly learn that:

- Most “deals” require little or no money down

- There are alternative finances that are not from the banks

If you just know this little known technique, you could be investing in your first property within 30 days.

If You’re Not Investing Money, You are Losing Money Every Single Day!

You will also learn…

- The quickest way to get you on the property ladder without saving for years

- The 1:10 strategy for you to retire early while others retire broke

- The 12 killer mistakes that could wipe you out in property

- How you can start your property business with as little risk as possible

- The “strategy” that eliminates your headaches and hassles from property once and for all.

- How to build your property success team that supports you

- How you could become a property deal magnet and never beg for deals again

Do or Die. Which One Would You Choose?

Whatever decision you make now will change your life forever.

Opportunities come and go. The question is how much longer are you willing to let opportunities pass you by, because it may not come again?

Everyone has the same 24 hours in the day so why are some people rich while others are poor. It’ not about your available resources; it’s about how resourceful you are.

My mentor once asked me that we have either reasons or results – which one is it going to be?

It’s time to change and do something different, isn’t it?

Here’s a quote that will help you decide.

I look forward to helping you succeed with whatever time we have left.

Best wishes,

![]()

P.S. Let me make a prediction that by the end of the event, you WILL come up to me, look me in the eyes and sincerely thank me for this opportunity.

I suggest you get on

the training

“I been working along side

Vincent and John and have now bought

20 houses from myself and

packaged up 11 deals £2,000 each.

I suggest you get on the training

and start taking the action.”

William Drummand

These guys know what

they are talking about

“Once a Skeptic not any more.

I bought a house valued at £150,000

for £100,000 me and my two nephews.

These guys know what they are

talking about.”

Steve Miller

Come and listen to Vince and John

“I went for the Wealth Dragons course and didn’t believe it could work,

but I put up all my energy

which got me my first lease option deal for a 7 year term and

made RM 21,000.

Come and listen to Vince and John.”

Raymond Lim

Get on this course,

invest and reap the benefits

“I did the Wealth Dragons course

and now I love the 7th of the month

because I have bought a property

where I get £247 Profit from my rent

every single month. Get on this course, invest in yourself

and reap the benefits!”

Rada

If I never went to the BC the I would never of made this money

“I did Wealth Dragon’s BC

18mths ago, paid £2000.

Closed one LO £213pcm cash flow…

And guess what?

An investor where we met at the BC

called me 6mths ago, and asked me

if I could sell some of his houses

on LO/IC? And this investor

has made me over £8k cash,

and just below £800 cash flow per mth.

If I never went to the BC the I would never of made this money.”

Fion Chen

Wealth Dragons took me

from where I am

to where I want to be

“I completed on a BMW deal, which I now rent every single month and non of my money was left in the deal. Wealth Dragons took me from

where I am to where I want to be.

I learnt how to source, negotiate

and strike a win/win deal.”

Bob Barrington

This bootcamp was

worth paying for

“Some of the information I learned

in just 10 minutes were just

phenomenal! I am now selling leads

and making a second income for us.

This bootcamp was

worth paying for.”

Margaret Ann

Bought/sold/rented out around 20 or so since you guys

“Personally I’ve bought 4 since The Wealth Dragons..

but my dad has put his name to

the others for me..

In terms of equity – about

£100,000 between the 4 of them

on sale. A property guy helped me

source them, he’s close friends

with my dad but he didn’t

find them for me..

I asked around my local area

(South Wales, Cardiff, Newport)

I guess I just got lucky with

how good the deals were.

2 of the properties are 3 bed

detached (Around £190,000 each)

and 2 of them are 2 bed semi’s

(Around £140,000 each)

Not exact figures but close.

All of them are rented out and

profit around £800 a month

from all 4 of them…

(i can show you calculations if needed).

My family has probably bought/sold/rented out around 20 or so since you guys :)”

Jade Lewis